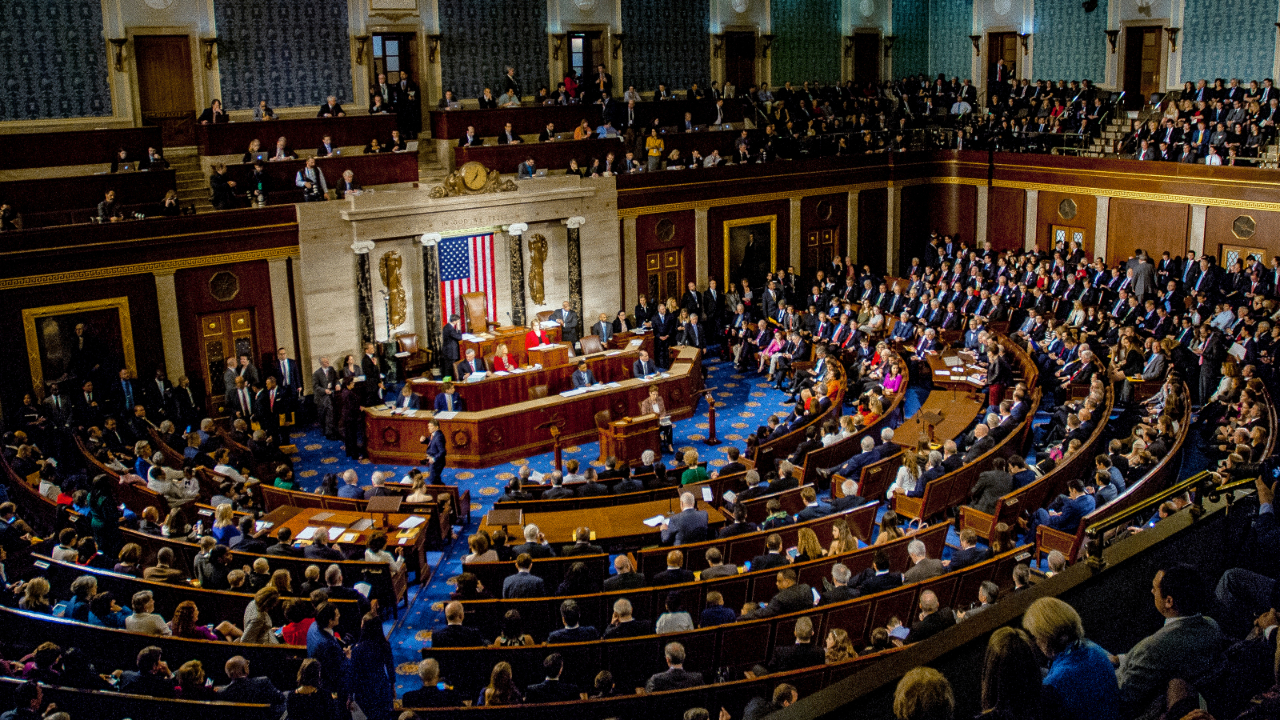

The GENIUS Act is headed to the President, who is expected to sign it Friday. The CLARITY Act now moves to the Senate floor, with the Senate Banking Committee preparing its own version. The Anti-CBDC Surveillance State Act does not yet have a Senate counterpart, though Republicans are expected to introduce one soon.

In other U.S. government news, President Trump appears to be preparing an executive order that would open up the $9 trillion U.S. retirement market (specifically 401(k) plans) to investments in gold, private equity, and cryptocurrencies like bitcoin. Meanwhile, rumors again swirled this week about Trump potentially firing Federal Reserve Chairman Jerome Powell. But those were temporarily quashed Wednesday when Trump told reporters that, despite his public criticisms, he was not planning to remove Powell.

After an explosive move through all-time high resistance last week, Bitcoin consolidated this week around $117K, despite upbeat economic data. Some market participants were spooked by the July 4th Bitcoin whale, who continued to move dormant coins, this time consolidating 40,000 BTC into a single address. Overall, it's been a quiet week for Bitcoin.

Ethereum, however, was a different story. The price action, combined with a barrage of bullish news, has revived the perennial and ironically-timed question: Has ETH/BTC bottomed or is this Ethereum's time to shine? This post on X captured the week's ETH highlights:

- Trump to sign Exec Order allowing crypto in 401ks

- Genius Act (stablecoin bill) passes House vote

- BlackRock files for ETH staking for its ETF

- SBET files to buy $5B more ETH

- ETH ETFs set inflow record with $727M

A few thoughts on these developments:

The primary benefactor of a Trump 401(k) EO will be Bitcoin, but Ethereum likely comes next. Once the GENIUS Act becomes law, Ethereum stands to gain significantly, as it still hosts the largest amount of stablecoins and remains the home of DeFi.

BlackRock's interest in staking for its spot ETH ETF could channel more flows into ether-specific products. While Bitcoin treasury strategies are maturing, and possibly yielding diminishing returns, ETH treasury plays remain smaller, underappreciated, and potentially more lucrative.

Since July 4, U.S. spot ETH ETFs have seen $2 billion in inflows. In just one week, they attracted a record high $908 million.

As Ethereum surged, altcoins followed. Bitcoin dominance fell from a local high of 66% three weeks ago to about 61.5% today. XRP reclaimed its $3.40 all-time high, XLM is up over 100% since the start of July, and Coingecko's "Meme" category is up 23% over the past seven days.

Pump.fun's ICO raised $600 million at $0.004 per PUMP token, selling out in just 12 minutes—making it the third most successful ICO in history. The token initially pumped over 80%, but is now correcting, down around 30% from its peak to roughly $0.0049.

Altcoins are pumping, ICOs are making history, and memecoins appear to be waking up. Are the good times back?

In traditional finance, a Goldman Sachs report shows meme stocks outperforming the broader market by 30% since April. While earnings season began this week, the bulk of reports will come in between July 28 and August 15. If companies surprise to the upside, expect a wave of equity exuberance that could easily spill over into crypto.

That said, expectations are muted. If results underwhelm, it's unclear how sharply markets will react. So far, the data has been a mixed bag, which hasn't materially affected equities nor crypto. Yet.

-David Sencil

0 Comments